Solutions for Lenders

Transform EV lending with comprehensive risk management and automated asset protection

Revolutionize EV Lending Risk Management

PerUse's Battery-as-a-Service platform transforms how lenders approach EV financing by providing real-time asset monitoring, automated payment processing, and comprehensive risk mitigation tools that reduce default rates while enabling competitive lending products.

- Real-time Asset Monitoring: Track battery health and vehicle performance continuously

- Automated Risk Assessment: AI-driven scoring models for enhanced underwriting

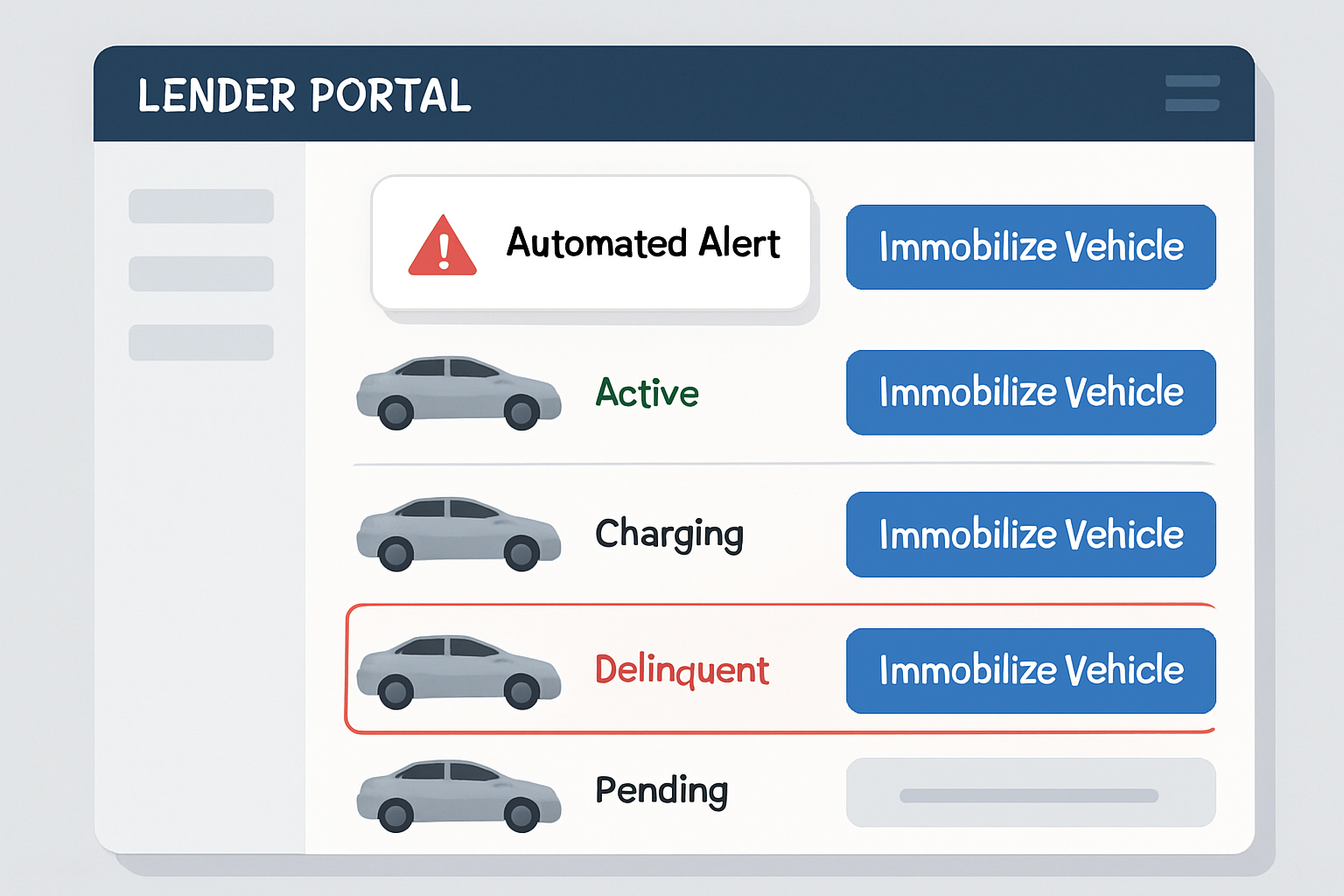

- Asset Protection: Remote battery control and location tracking for security

- Streamlined Collections: Automated payment processing and default prevention

Our platform integrates seamlessly with existing lending systems, providing lenders with unprecedented visibility into EV assets while reducing operational complexity and enabling data-driven lending decisions.

PerUse Lending Design Principles

Foundational constructs enabling resilient EV credit portfolios

Asset-Aligned Financing

Separate chassis vs battery exposure to reflect distinct depreciation and residual risk curves.

Usage-Driven Repayments

Per‑km pricing aligns cash flows with realized utilization; mitigates negative equity drift.

Data-Backed Optimization

Live battery health + route + utilization signals feed underwriting, pricing, and recovery.

Equity Protection

Amortization logic ensures principal outstanding remains below conservative residual value.

Dynamic Monetization

Tiered, surge, prepaid, and blended usage tariffs enhance yield while preserving flexibility.

Regulatory-First Architecture

SARFAESI-ready structuring, transparent SOA generation, auditable control & consent logs.

Monetization Beyond Lending

Battery condition intelligence powers resale value, insurance calibration & fleet refinancing.

Compliance by Design

PerUse embeds governance, auditing, disclosure and enforcement frameworks into the core platform—reducing operational burden while strengthening borrower trust.

Customer Consent & Privacy

- Explicit telematics & control consent

- DPDP-aligned storage & retention

- Easy opt-out for data sharing

SARFAESI & Recovery

- Dual SMA status tracking

- Battery + shell dual-loan schema

- Auto-debit prioritization logic

Regulatory Alignment

- Alternate amortization (IRACP)

- Transparent pricing splits

- EIR computation & export

Reporting & Transparency

- SOA: km, per‑km, balloon, dues

- Real-time usage & threshold alerts

- Event & DPD classification logs

Market Shifts & Lending Challenges

EV lending economics are fundamentally different. Battery value behavior, upgradeability, and emerging ownership patterns are rewriting underwriting logic and residual value assumptions.

- Battery is a consumable: Treated like fuel; customers prepay or subscribe for energy access.

- Residual value shifts: Driven by remaining charging cycles, not just vehicle age.

- Upgrade paths: Both hardware and software can extend usable life & alter collateral value.

- Dealer centricity challenged: OEM-direct and platform-led distribution are rising.

- Alternate ownership models: Subscription, battery leasing, pay-as-you-go, and tech-enabled lending are scaling.

Mainstream vs New-Age Lending

Traditional lenders struggle with EV complexity while new-age fintech companies leverage technology for competitive advantage. PerUse bridges this gap by making sophisticated EV lending accessible to all institutions.

- Simplified EV underwriting processes

- Automated compliance and documentation

- Real-time portfolio performance insights

Remove Technology Complexity

Focus on your core lending business while PerUse handles the technical complexity of EV asset management, battery monitoring, and IoT integration.

- Plug-and-play integration with existing systems

- White-label solutions maintain your brand identity

- 24/7 technical support ensures smooth operations

Real-time Visibility & Control

Gain unprecedented insight into your EV loan portfolio with live battery health monitoring, location tracking, and performance analytics.

- Battery degradation tracking and alerts

- Vehicle usage patterns and risk indicators

- Automated early warning systems

Evolving EV Financing Models

Loan structures are being re-architected to reflect Battery-as-a-Service (BaaS), subscription packs, and pay-as-you-go usage contracts.

Digital-first NBFCs and OEM-linked financiers are experimenting with subscription-based loans, battery leasing, blended EMI + usage pricing, and residual-protected balloon constructs. This shift enables margin resilience and customer stickiness.

PerUse provides the telemetry, asset segmentation, and payment orchestration rails needed to confidently price, service, and enforce these new models at scale.

Emerging Constructs

- Battery subscription layered over financed chassis

- Hybrid EMI + per‑km usage recovery streams

- Deferred / balloon structures aligned to residual protection

- Dynamic repricing triggered by health + utilization bands

- Telemetry-driven covenant & early‑warning enforcement

Ready to Transform Your EV Lending?

Discover how PerUse's Battery-as-a-Service platform can reduce your lending risk while enabling competitive EV financing products.

Partner with Us